A2102 Insights

Explore the latest trends and news on technology, lifestyle, and more.

Whole Life Insurance: The Secret Sauce to Long-Term Financial Flavor

Unlock the secrets of whole life insurance and discover how it can spice up your long-term financial health!

Why Whole Life Insurance is the Key Ingredient for Your Financial Future

Whole life insurance is not just a policy; it’s a cornerstone of a secure financial future. Unlike term life insurance, which provides coverage for a specific period, whole life offers lifelong protection, allowing you to build cash value over time. This dual benefit ensures that your loved ones are financially protected while your investment grows. The cash value component can be accessed through loans or withdrawals, providing you with a financial cushion during emergencies or opportunities that arise. Therefore, incorporating whole life insurance into your financial strategy can significantly enhance your wealth-building efforts and provide peace of mind.

Moreover, the predictability of whole life insurance makes it an attractive option for those looking for stability in their financial planning. With fixed premiums and guaranteed benefits, you can plan your finances with confidence. The dividends, if any, can be utilized to increase the policy’s cash value or can even be taken as cash, creating additional income streams. In a world filled with financial uncertainty, whole life insurance stands out as a strong safeguard, enabling you to focus on your long-term goals while ensuring that your family’s financial future remains bright and secure.

Unlocking the Benefits of Whole Life Insurance: A Comprehensive Guide

Whole life insurance is more than just a safety net for your loved ones; it offers a wealth of benefits that can significantly enhance your financial planning. One of the key advantages is cash value accumulation. As you pay your premiums, a portion goes into a cash value account, which grows at a guaranteed rate over time. This cash value can be borrowed against or withdrawn in times of need, providing liquidity that traditional term policies lack. Additionally, whole life insurance guarantees a death benefit, ensuring your family is financially secure even after you're gone.

Another important benefit of whole life insurance is its stability and predictability. Unlike term insurance that expires after a set period, whole life insurance remains in force for your entire lifetime, as long as premiums are paid. This serves not only as a long-term financial investment but also as a tool for estate planning. Furthermore, the dividends from whole life policies can be utilized to purchase additional coverage, increasing your death benefit over time without significantly affecting your premium outlay. In essence, whole life insurance can be a cornerstone of a sound financial strategy.

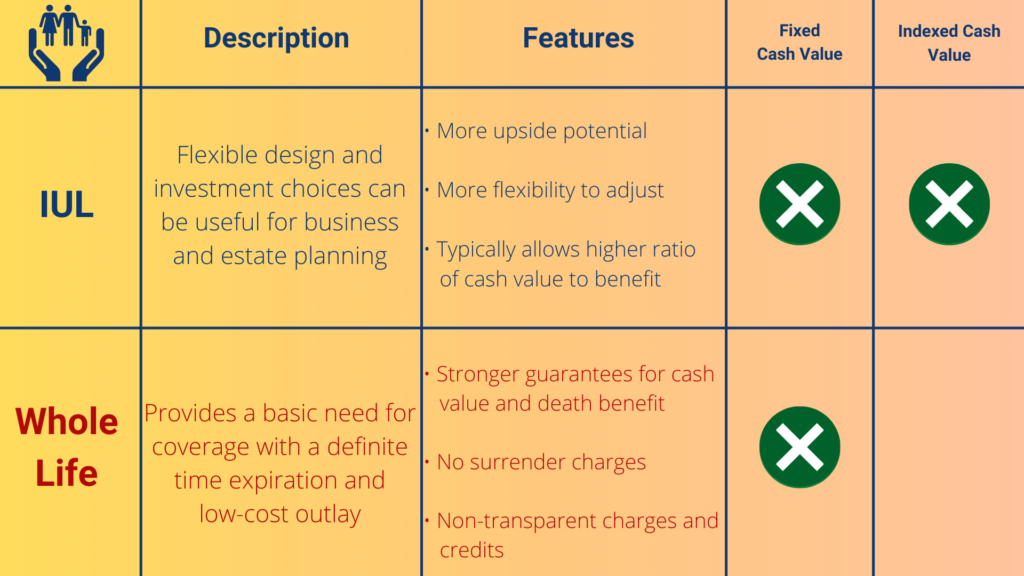

Is Whole Life Insurance Right for You? Exploring the Pros and Cons

When considering whether whole life insurance is right for you, it's essential to weigh the pros and cons. On the positive side, whole life insurance offers lifelong coverage, which means your beneficiaries will receive a death benefit regardless of when you pass away, as long as premiums are paid. Additionally, this type of insurance builds cash value over time, allowing policyholders to borrow against it or even surrender the policy for cash if needed. This makes whole life insurance not just a safety net for your loved ones, but also a potential financial asset.

However, there are significant downsides to consider. One of the primary criticisms of whole life insurance is the high premium costs compared to term life insurance. Many financial advisors argue that for the same premium, you can secure a larger death benefit with a term policy and invest the difference elsewhere. Furthermore, the cash value growth in whole life policies tends to be relatively slow, and surrendering the policy early often results in significant fees. Therefore, it's crucial to evaluate your financial goals and needs when deciding if whole life insurance aligns with your overall strategy.